A personal finance blog lets you:

Earn passive income by solving real money problems people Google daily

Deepen your financial knowledge through research and reader interactions

Master digital marketing by learning what content actually ranks

Here’s why this type of blog still works:

- High Demand – 74% of adults worry about finances (Forbes)

- Evergreen Content – Money questions never go out of style

- Multiple Income Streams – From ads to affiliate offers

Get Inspired by Success Stories: Check out these top-performing finance blogs to see what works in this niche.

Ready to begin? You can aslo follow our step-by-step guide to starting a profitable blog makes it easy to launch in under 30 minutes.

5 Quick Steps to Get You Going

1️⃣ Choose Your Sub-Niche (e.g., “Frugal Living Tips,” “Stock Market for Beginners,” or “Credit Card Hacks”)

2️⃣ Sign Up with a Web Host (Use HostGator to secure hosting + a free domain)

3️⃣ Set Up WordPress (Best for SEO and easy customization). You can do this within your HostGator account. Install a pre-built site, customize it, and start publishing without needing to code.

4️⃣ Create Essential Content:

- “Best Budgeting Apps for 2025”

- “How to Start Investing With $100”

- “Credit Cards With the Best Rewards”

5️⃣ Use Professional Graphics (Clean, modern, and trustworthy visuals)

What HostGator Offers: A free domain name and easy access to WordPress.org, your blogging platform.

Pro Tip: You don’t need to be tech-pro to start—setting up a blog is as easy as managing your Facebook or TikTok account. Plus, HostGator lets you try it risk-free with their 30-day money-back guarantee. If it’s not for you, just cancel and get a full refund—no hassle.

5 Ways You Can Monetize Your Blog and Start Making Money

💰 Affiliate Links: (Earn from financial tools like Credit Karma, Robinhood, or personal finance courses)

💰 Ad Revenue: You can do this on the go, Google AdSense is the most reputable, with free and easy to set up

💰 Sponsored Posts: ($200 − $3k from fintech companies and banks)

💰 Digital Products: (Sell budgeting templates or investing ebooks)

Benefits of Starting a Finance-based Blog

- Make $8,000 – $20,000/month: You can turn your blog into a full-time income, all while doing something you enjoy and helping others take control of their finances.

- Super Quick and Affordable to Start: Setting up your blog takes less than 10 minutes, and you can get started for as low as $3.50/month, with no hefty upfront investment required.

- Start Earning Fast: You can begin monetizing immediately through ads and affiliate marketing. No waiting for a huge following or massive traffic.

- No Technical Skills Are Required: You don’t need to be a tech whiz! With easy-to-use templates, you can set up and customize your blog to fit your niche and financial focus with ease.

- Connect with Like-minded Individuals: Your blog will attract readers who are looking for financial tips, advice, and inspiration, exactly what you’re offering.

- Paid Partnerships and Sponsorships: As your blog grows, financial brands and companies will approach you for paid collaborations, providing extra income as you promote relevant products and services.

- Work From Home, On Your Own Terms: Starting your finance blog is an opportunity open to anyone, no matter where you are located in the world.

Many personal finance bloggers are making up to $15k, and this could be you.

So, why wait? You can get started today, publish your first few posts, monetize them, and start making money. And as you learn, you will improve your site and grow your traffic and income. The possibilities are endless.

Find More: Here are Real Income Reports From 10 Different Personal Finance Bloggers to Inspire Your Journey

Can I Start a Blog for Free?

Yes, you can start a free blog on platforms like WordPress.com or Blogger—but there are trade-offs:

- Limited control: Free platforms can restrict ads, plugins, and even delete your blog.

- Unprofessional branding: You’ll have a generic URL (e.g., yourblog.wordpress.com).

- Fewer monetization options: Affiliate links and ads are often blocked.

A self-hosted blog (like WordPress.org) solves these issues with full ownership, custom domains, and unlimited income potential. While it costs $3 – $10/month for hosting and a domain, it’s worth it for long-term growth.

Want to explore both paths? Check out these guides:

- How to start a free blog and make money (for those who want to grow their experience before starting a real money-making blog)

- Blog vs YouTube: Which is more profitable

- What is a self-hosted blog that makes money? (key differences explained)

- How much does it cost to start a blog? (real pricing breakdown)

What you need to get started

To build a profitable finance blog that stands out, you’ll need these 5 key components:

1️⃣ A Reliable Computer

- Any laptop/desktop with internet access

- Manage your blog, research topics, and write content efficiently

2️⃣ A Memorable Domain Name

- Choose something like WealthWiseTips.com or DebtFreeJourney.net

- Keep it short, brandable, and finance-related

3️⃣ WordPress.org (The Best Platform)

- Free, powerful, and used by top finance bloggers

- Thousands of free themes and plugins available

- No coding skills required

Tip: Find other blogging platforms

4️⃣ Premium Web Hosting (Critical for Success!)

For new finance bloggers, we strongly recommend: 👉 HostGator

✔ 1-click WordPress install (get started in minutes)

✔ 99.9% uptime (your blog never goes down)

✔ 24/7 expert support (help when you need it)

✔ Special discount for our readers

👉 I used HostGator to launch my finance blog – had WordPress installed and was publishing my first post in under 30 minutes!

Tip: Find other web hosting providers just like HostGator

5️⃣ Essential Free Tools

- Astra/GeneratePress (lightweight themes)

- Yoast SEO (optimize your content)

- Canva (create eye-catching graphics)

🚀 Ready to Start? Get HostGator Now at 60% OFF → Your blog could be live today!

Affiliate Disclosure: This post may include affiliate links with special discounts. Using them saves you money and supports our site at no extra cost to you. Win-win right! Check out our [Privacy Policy] for more details. Thanks for your support!

How to Start a Personal Finance Blog Step by Step and Make Money

HostGator makes it easy to get your site up and running and start your blog quickly. It’s a reliable choice for new bloggers.

Here is a quick step to get you done in minutes!

- Step 1: Starting within a finance-related sub-niche

- Step 2: Click on HostGator to get you started

- Step 3: Select your ideal HostGator hosting plan

- Step 4: Choose a unique domain name for your blog

- Step 5: Pick your preferred hosting subscription period

- Step 6: Create your HostGator account

- Step 7: Install WordPress in your HostGator account

- Step 8: Choose a pre-built theme within WordPress

- Step 9: Customize your site, create essential pages, and start publishing blog posts

Step 1: Start Within a Finance-related Sub-niche

Starting within a specific blogging niche around finance or business content category makes it easy for Google and your audience to understand your site better. You can expand into other areas of personal finance later on if you feel you’ve exhausted content ideas within a specific sub-niche.

Below are some of the most profitable sub-niches in finance blogging you can start from:

- Sub-niche 1: Credit & Loans – Offers advice on improving credit scores, choosing credit cards, managing debt, and understanding loan options.

- Sub-niche 2: Side Hustles – Provides ideas for part-time jobs, gig economy work, and online business opportunities to help individuals earn extra income alongside their main job.

- Sub-niche 3: Personal Finance – Focuses on budgeting, saving, debt management, and retirement planning. It provides practical advice to help individuals manage their money better.

- Sub-niche 4: Investing – Covers topics related to the stock market, real estate, cryptocurrency, and other investment opportunities. It helps readers grow their wealth through informed investment decisions.

Find More:

Here are finance blog topic ideas in different sub-niches, which makes it easy for you to start and find topics within the sub-niche you are interested in.

Struggling to Find Finance Blog Topics?

We’ve curated 250+ profitable finance blog ideas across popular sub-niches like:

- Investing (e.g., “How to Start With $100”)

- Side Hustles (e.g., “Apps That Pay You to Walk”)

- Debt Payoff (e.g., “Snowball vs. Avalanche Method”)

👉 Explore our full list of Finance Blog Topic Ideas to kickstart your content calendar!

Need More Inspiration?

Try these free blog post generators to brainstorm viral-worthy topics:

- Google Trends – Use to find viral and trending topics

- Free Keyword Research Tool – Find low-competition gems

- AI Blog content writer – Helps to generate content ideas and create quality content

Pro Tip: Use keyword research tools to ensure your selected topics are what people are already searching for.

Step 2: Click on “HostGator” To Get You Started

Our readers can use our unique HostGator discounted link on this page to get started for a much lower price.

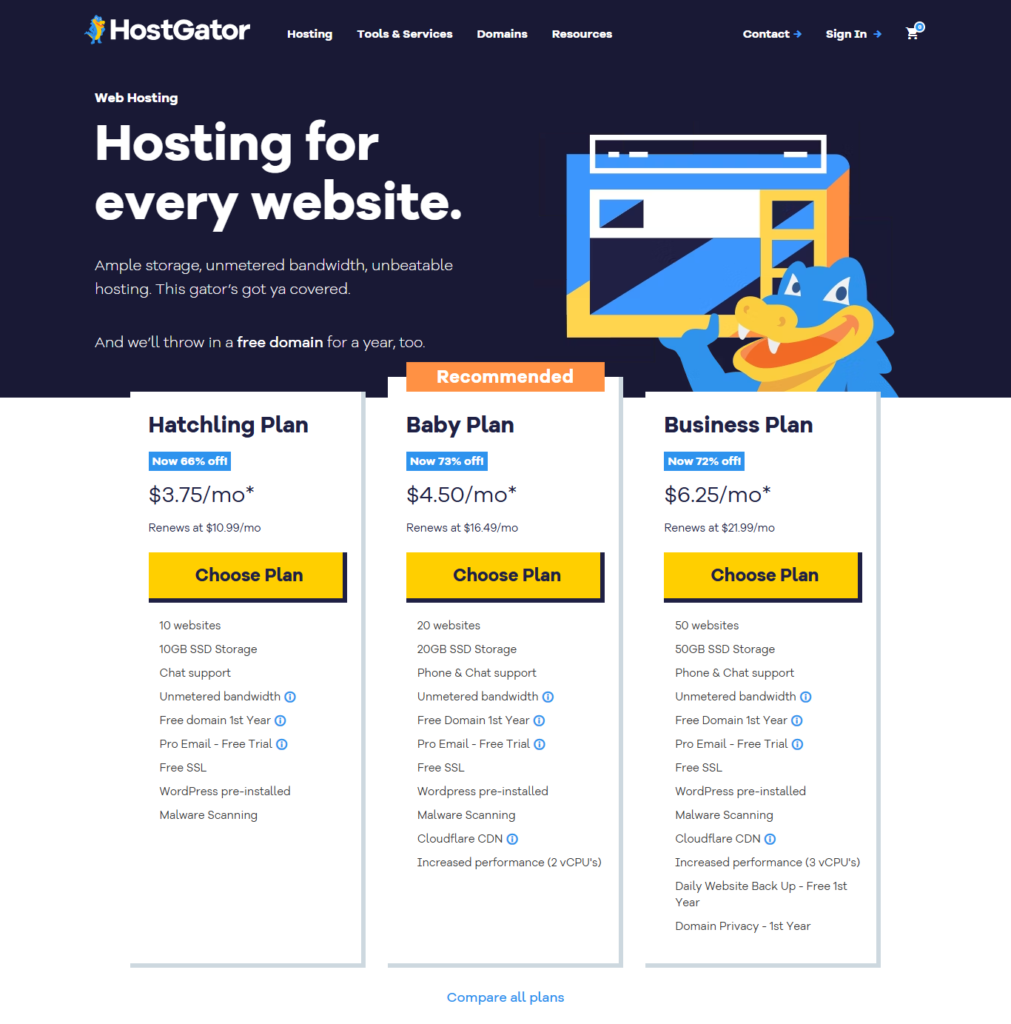

Step 3: Choose Your Preferred HostGator’s Hosting Plan

HostGator’s “hatchling plan” is the most affordable and best option for complete beginners since you can always upgrade your plan anytime you want. Preferably, when your blog starts making money and receiving a huge amount of monthly traffic.

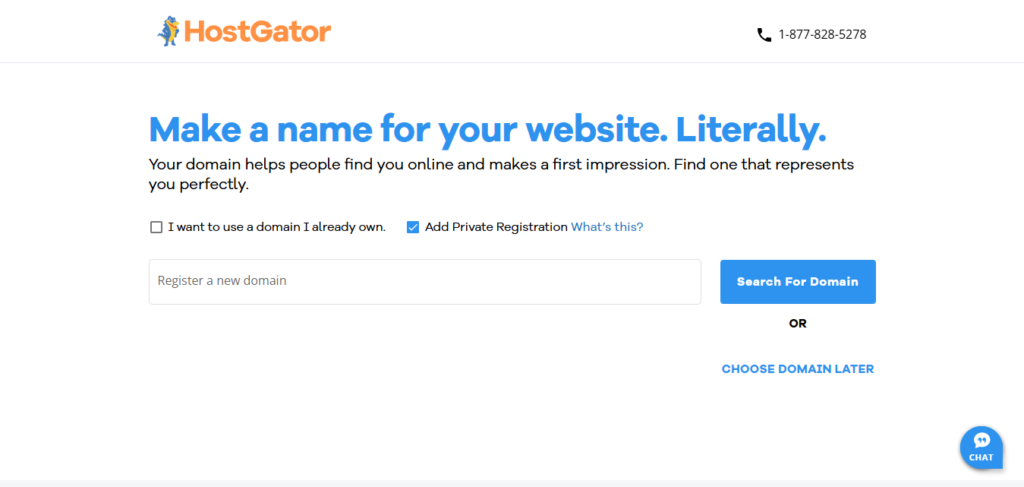

Step 4: Pick a Unique Domain Name Of Your Choice

After selecting your hosting plan, you’ll be directed to a page where you can create your unique domain name and complete the sign-up process.

Choosing the Perfect Domain Name for Your Finance Blog: Key Considerations

Your domain name is your online identity, so choosing wisely is crucial. Here’s what to consider:

1. Make It Domain Name Memorable and Easy to Spell:

- In the fast-paced world of finance, clarity is key. Avoid complex spellings or jargon that might alienate your audience.

- Example: Instead of “FinancialStrategies4U,” consider “SmartMoneyTips” or “WealthBuilderBlog.”

- Remember, you want people to easily share and revisit your blog.

2. Ensure It Reflects Your Finance Niche:

- Clearly indicate the type of financial content you’ll be providing. Are you focusing on personal finance, investing, retirement planning, or something else?

- Examples:

- For personal finance: “BudgetWiseBlog,” “DebtFreeLiving,” “MoneyManagementHQ.”

- For investing: “InvestorInsights,” “StockMarketSavvy,” “GrowthFundGuide.”

- For crypto: “CryptoCurrencyCorner”, “DigitalAssetDaily”, “BlockChainBasics”

- Using relevant keywords in your domain can also improve your blog’s search engine visibility.

3. Keep It Short and Sweet:

- In the digital age, brevity is valued. Aim for a domain name that’s concise and easy to remember.

- Shorter names are more likely to be shared and recalled, which is essential for building a loyal readership.

- Keep in mind that long domain names are easier to mistype.

4. Make It Easy to Read and Pronounce:

- Your domain name should flow smoothly when spoken aloud. This is particularly important for podcasting or video content.

- Avoid letter combinations that might be confusing or difficult to pronounce.

- When people talk about your blog, you want it to be easy to say.

Pro Tip: If the domain name you intend to use is taken, you can make some adjustments, like;

- Add a word (like FinanceSmartTips.com)

- Try a different ending (FinanceSmart.co)

- Tweak with My/The/Online (MyFinanceSmart.com)

- Shorten it (FinSmart.com)”

Relevant – Find More Than 200 Unique Finance-based Blog Name Ideas and Their Meaning

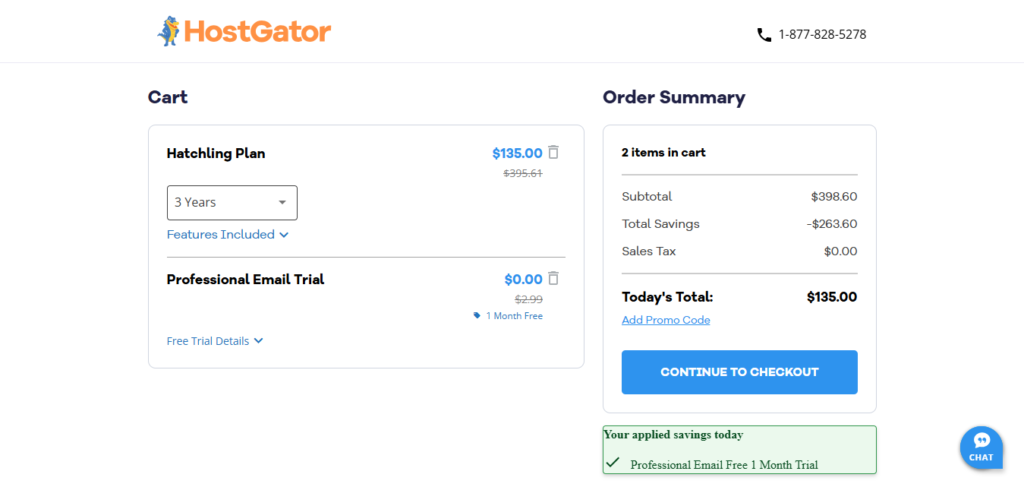

Step 5: Choose Your Preferred Hosting Subscription Period

Ensure you’re selecting the Hatchling plan on the right-hand side, and adjust your subscription period to either 1 year or 36 months, depending on what fits your budget at the time.

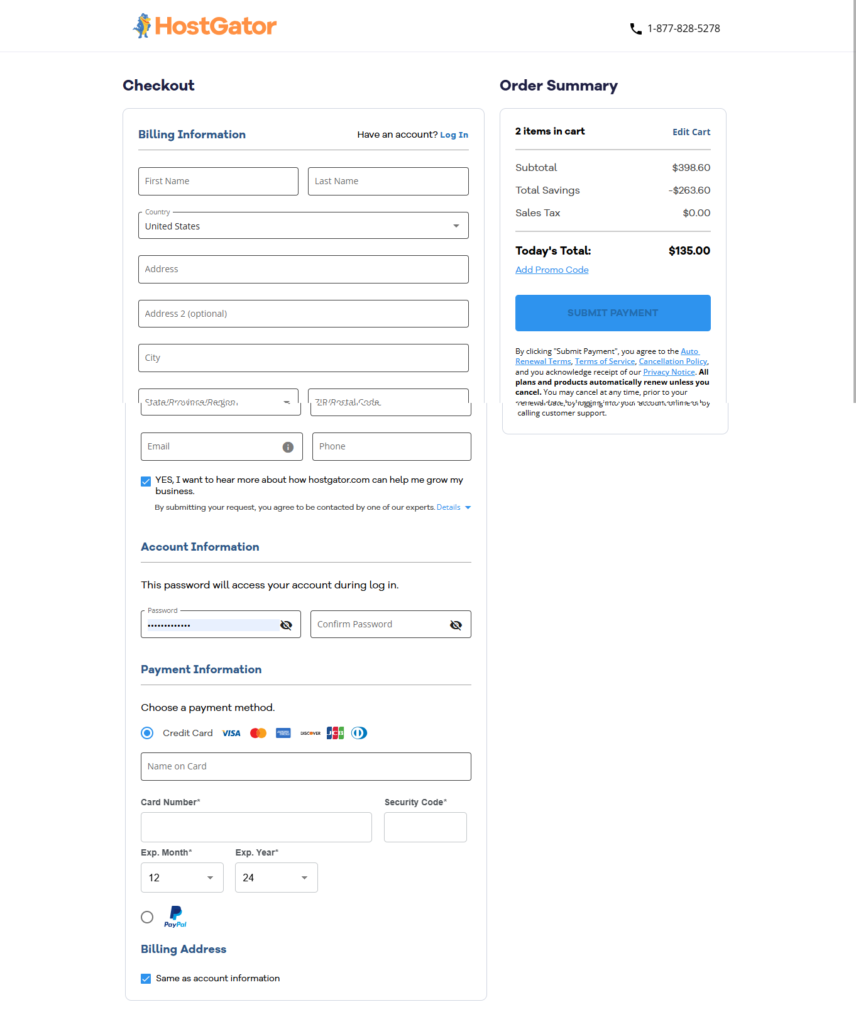

Step 6: Create Your HostGator Account

Create your HostGator account by entering your email address, providing your contact information, and selecting a secure password.

Double-check your order details and the information you’ve entered to make sure everything is correct, then proceed to checkout.

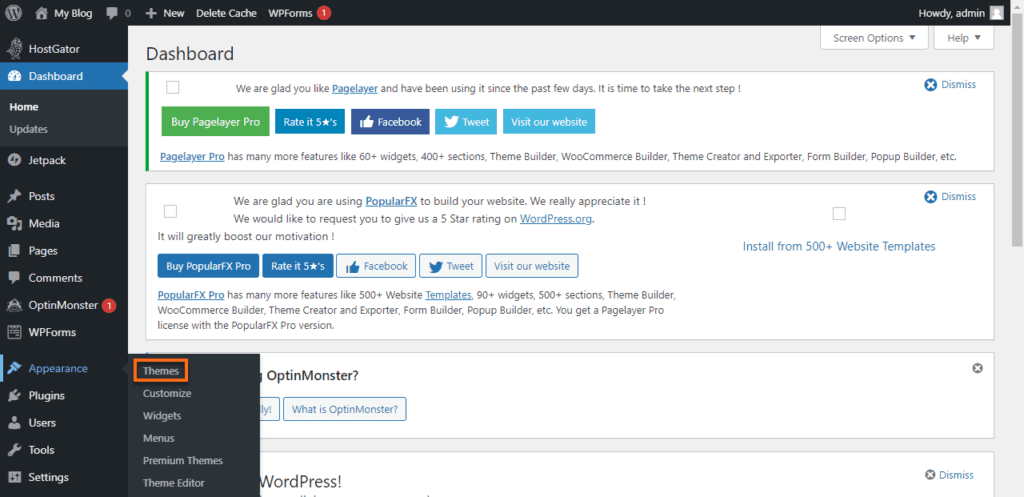

Step 7: Install WordPress Within Your HostGator Account

After completing your HostGator sign-up, follow the on-screen instructions to finish setting up and installing WordPress.

Other Alternative Method:

- Log in to your HostGator account.

- In the home section, find and click on the “WordPress” option.

- Follow the prompts to create your WordPress account.

- Once created, you’ll be automatically logged in and ready to start customizing your site and creating blog posts.

Step 8: Within WordPress, Choose a Blog Theme [A Pre-built Site]

Themes are pre-designed website templates that you can choose, preview, and customize to fit your needs.

Here’s a simple guide to selecting the perfect WordPress theme for your personal finance blog;

- Navigate to Themes – In your WordPress admin dashboard, above, go to Appearance > Themes to see available themes.

- Browse the Theme Library – Here you can find a wide variety of themes available for your blog, and you can also use the search bar to search based on finance-related keywords to find something that matches your style.

- Filter Your Options – Refine your search using filters like features (customization, social media integration), layout (clean, modern, easy-to-read), and mobile-friendliness.

- Preview Before Committing – Click “Preview” on a theme you want to see how it looks with your content and ensure it performs well on mobile devices.

- Check Reviews and Ratings – Look at user reviews and ratings to gauge the theme’s quality, performance, and support before making your final decision to use.

- Mobile-Friendly is Essential – Ensure the theme is responsive and looks great on mobile devices, just like I said before.

- Consider Paid Themes – If free theme designs don’t meet your needs, you can explore premium options that offer more features and customization. Just make sure you’re comfortable using WordPress before investing in a paid one.

Popular Themes for Personal Finance Blogs:

- Astra (Customizable and responsive)

- GeneratePress (Lightweight and fast)

- Zillah (Clean, stylish design)

Here are some of the best WordPress themes for your blog.

Step 9: Customize Your Blog Layout and Set up Your Main Pages

- Personalize Your Blog: Use your theme’s customization options to adjust colors, fonts, and layouts to match your style.

- Set Up Essential Pages: Most themes come with pre-built layouts for pages like “About,” “Contact,” and “Home.” Customize these templates to suit your needs.

Congratulations at this point, following all the steps above, you’ve created a fully functional blog, you can use to start publishing content about business & finance. Your site is now visible on Google and accessible online.

You can watch the video below to help make it easier for you to understand!

This video is a detailed illustration of the whole process of how to set up your WordPress blog using HostGator, in an easy way to follow.

After watching the video, follow these steps to find profitable business and finance blog topics and get your blog up and running!

How to Find Profitable Finance Blog Topics (Fast & Easy)

To successfully monetize your personal finance blog, you need to publish blog posts to gradually grow your traffic and make more money through affiliate marketing and ad placements.

1. Spy on What’s Trending

- Use Google Trends or BuzzSumo to spot rising topics (e.g., “inflation-proof investments”).

- Check news sites (CNBC, Bloomberg) for fresh angles on taxes, crypto, or debt relief.

2. Answer Burning Money Questions

People search for solutions—so write about:

✔ “How to pay off $10K debt fast?”

✔ “Best side hustles for passive income?”

(Need ideas? Here are 250+ finance blog topics to steal!)

3. Steal (Ethically) from Competitors

- Analyze top finance blogs (NerdWallet, The Balance).

- See which of their posts get most shares/comments—then write a better version.

4. Use Keyword Tools to Find Gaps

- Plug terms like “best credit cards” into SEMrush or Ahrefs.

- Target low-competition, high-traffic keywords.

5. Ask Your Audience Directly

- Run polls on Instagram Stories or Facebook Groups.

- Check Reddit’s r/personalfinance for real struggles.

6. Try a Blog Topic Generator

Stuck? Use a free blog post idea generator to spark creativity.

Pro Tip: Mix evergreen content (e.g., “How to build credit”) with trending topics (e.g., “2025 tax changes”) for steady traffic + viral potential.

Now go write a post that ranks—and earns!

How to Write a Great Blog Post (Easy & Effective Tips)

1. Hook Readers with a Strong Intro: Grab attention fast—ask a question, share a surprising stat, or tell a short story.

For Example: “Did you know 60% of Americans can’t cover a $1,000 emergency? Let’s fix that.”

2. Keep It Easy to Read

- Short paragraphs (2-3 sentences max)

- Subheadings (break up sections)

- Bullet points & lists (like this one!)

(Need formatting help? Check out these 7 best blog post formats.)

3. Use Simple, Friendly Language: Avoid jargon. Write like you’re explaining to a friend—warm and helpful.

4. Add Visuals for Clarity: Charts, infographics, or even memes make complex ideas easier to digest.

5. End with a Clear Next Step: Ask readers to comment, share, or explore more (e.g., “Want more tips? Read our high-quality blog post guide.”).

Boom! A blog post that’s engaging, easy to read, and effective.

Other Relevant Post:

- How to format your blog post

- How long should a blog post be

- How many blog posts do you need to make money

- How To Write Attractive Blog Headlines for Your Blog Posts

How to Hire a Good Blog Writer

If writing isn’t your thing, hiring a freelance writer can ensure you create competitive content that people will find relevant.

- Find Experienced Writers – You can search for freelance writers on platforms like Upwork, Fiverr, or ProBlogger. Look for those with experience in personal finance writing to ensure they understand your niche.

- Be Clear About Your Needs: When hiring a writer, clearly specify the tone, style, and topics you want covered. Setting expectations ensures the content aligns with your blog’s voice.

- Request Writing Samples: Always ask for writing samples or a portfolio to evaluate if the writer’s style matches your blog’s approach and appeals to your target audience.

Relevant Post: How to Hire A Good Finance Blog Writer

By implementing these strategies, you’ll be able to craft engaging and informative content that connects with your audience and drives the growth of your personal finance blog.

How to Monetize Your Personal Finance Blog (And Start Earning Fast)

1. Display Ads (Easy Passive Income)

One of the most straightforward ways to start making money with your personal finance blog is through display ads.

Best for: New bloggers | Earnings: $500–$3,000+/month (with steady traffic)

How to Set Up Ads:

✅ Step 1: Sign up for Google AdSense (free & beginner-friendly).

✅ Step 2: Add the AdSense code to your blog (WordPress plugins make this easy—see best blogging platforms).

✅ Step 3: Place ads in high-visibility spots (sidebar, header, within content).

💰 Pro Tip:

- Get approved faster with 10+ published posts.

- Upgrade later to higher-paying ad networks like Mediavine or AdThrive.

📊 Real Earnings: Some finance bloggers make $5,000+/month—see finance blog income reports for proof!

Relevant Post to help boost ad earnings

- How to increase your blog pageviews [helps to increase your ad revenue]

- How to increase your blog retention time [helps to increase your ad revenue]

- How many blog posts do you need to make money

2. How to Make Money with Affiliate Marketing on Your Finance Blog

Affiliate marketing is one of the most profitable ways to monetize a personal finance blog. By recommending products you trust, you earn commissions—while helping your readers make smart money moves.

Step 1: Find the Best Affiliate Programs

Not all programs are equal. Focus on high-converting offers in personal finance:

✅ Amazon Associates – Great for books, planners, and financial tools.

✅ Financial Apps & Services – Personal Capital, Mint, SoFi, and credit cards.

✅ Affiliate Networks – ShareASale & CJ Affiliate offer thousands of finance-related programs.

✅ Niche-Specific Programs – Check out top financial affiliate programs for hidden gems.

Step 2: Sign Up & Get Your Unique Links

- Apply to programs that fit your niche (some require approval).

- Once accepted, grab your tracking links—these ensure you get paid for referrals.

Pro Tip: Always disclose affiliate links (FTC requirement + builds trust).

Step 3: Strategically Place Links in Your Content

Don’t just drop links—embed them naturally where they add value:

📌 Product Reviews – “Why I Switched to [XYZ Budgeting App] (Affiliate Link)”

📌 “Best of” Lists – “5 Best Credit Cards for Travel Rewards in 2025”

📌 How-To Guides – “How to Track Your Net Worth (Tool I Use)”

(Want inspiration? See real finance blog examples.)

How Much Can You Earn?

- Beginner: $300 – $3,000/month (low traffic)

- Established: $1k – $12k+/month (consistent traffic)

- Top Performers: $20k+/month (scaling with email lists & SEO)

📈 See real finance blog income reports for proof.

💡 Pro Move: Combine affiliates with other monetization methods (ads, digital products) for max earnings!

Find More: Relevant Posts to help boost your traffic and affiliate earnings

- Affiliate-based blog topic ideas

- How to promote your blog posts

- How to increase your blog traffic

- Effective blogging strategies that work

- How long does it take to make money blogging

- Other methods you can use to monetize your finance-based blog

Examples of Successful Finance & Business Blogs

Below are some examples of successful finance bloggers to inspire you.

With their blog’s insight, such as their;

- Blog’s focus overview

- Their monthly Traffic

- Their monthly Income

- Their published number of posts, and

- Their methods of monetization

[1]. A Self Guru – 78,000/month

Focus: Helping bloggers, small businesses, and freelancers legally protect their businesses with affordable legal templates.

Blog’s Insights

- Founder – Amira Irfan

- Number of published blog posts – 200+

- Monthly Traffic – 40,000

- Blog methods of monetization – Legal templates, affiliate marketing, and sponsored content.

[2]. Believe in a Budget – Over $42,000

Focus: Teaching readers how to save money, budget effectively, and generate extra income through side jobs like Pinterest management.

Blog’s Insight

- Founder – Kristin Larsen

- Number of published blog posts – 250+

- Monthly Traffic – 43,000

- Blog methods of monetization – Affiliate marketing, online courses, and ad revenue.

[3]. Adam Enfroy – Over $101,814/month

Focus: Helping bloggers and entrepreneurs scale their blogs using SEO and affiliate marketing strategies.

Blog’s Insights

- Founder – Adam Enfroy

- Number of published blog posts – 400+

- Monthly Traffic – 253,000

- Blog methods of monetization – Mainly Affiliate marketing and online courses. Partially display ads [from Mediavine], and consulting services.

[4]. Ryrob – $35,218/month

Focus: Ryan Robinson’s blog, Ryrob, offers in-depth advice on starting a blog, making money online, and growing a profitable business. He focuses on strategies for affiliate marketing, freelancing, and blogging.

Blog’s Insights

- Founder – Ryan Robinson

- Number of published blog posts – 400+

- Monthly Traffic – 550,000

- Blog methods of monetization – Affiliate marketing, sponsorships, and online courses.

[5]. Dollar Sprout – $99,644/month

Focus: DollarSprout provides actionable advice on managing finances, finding ways to save, and exploring side hustles and work-from-home opportunities. The blog focuses on helping readers improve their financial situation through budgeting, investing, and entrepreneurship.

Blog’s Insights

- Founder – Jeff Proctor and Ben Huber

- Number of published blog posts – 400+

- Monthly Traffic – 316,000

- Blog methods of monetization – Affiliate marketing, display ads [Mediavine], and sponsorship

Relevant Posts: Finance blog income reports to inspire you

How to Promote Your Finance Blog To Get Traffic

If you want more people to find your finance blog, you’ve got to actively promote it.

Here are some of the best methods you can use to promote your blog and increase your blog traffic as a beginner;

1. Master SEO for Free Organic Traffic: Best for long-term growth

✅ Keyword Research

- Use tools like Ubersuggest to find high-traffic, low-competition finance keywords (e.g., “how to save $10K fast”).

✅ On-Page Optimization

- Include keywords in:

- Titles & headers (H1, H2)

- Meta descriptions

- Image alt text

(Need formatting help? See best blog post structures.)

✅ Build Backlinks

- Guest post on finance blogs (learn how to start guest blogging).

- Get featured in roundups or interviews.

Tools: Check out the best SEO tools for bloggers.

2. Leverage Pinterest (Underrated Traffic Source)

📌 Ideal for visual-friendly finance tips

- Create eye-catching pins (Canva templates work great!).

- Optimize pin descriptions with keywords (e.g., “debt payoff strategies”).

- Post consistently—3-5 pins/week.

💡 Pro Tip: Use Pinterest SEO strategies to rank higher.

3. Engage on Quora & Reddit

💬 Drive targeted readers for free

- Answer finance questions on Quora (e.g., “How to start investing with $100?”).

- Drop helpful blog links (no spam!).

- Join Reddit threads like r/personalfinance:

- Share insights, then link to deep-dive posts.

4. Tap into Facebook Groups

👥 Build community & clicks

- Join budgeting/investing groups.

- Share value-first (e.g., “Here’s how I saved $5K last year [blog link]”).

- Run targeted FB ads ($5/day can work!).

5. Repurpose Content for More Reach

♻ Maximize every post

- Turn blogs into Twitter threads, LinkedIn posts, or Instagram carousels.

- Create short videos summarizing tips (TikTok/Reels).

Key Takeaway

Promoting your blog doesn’t have to be complicated. A mix of SEO, Pinterest, Quora, Reddit, and Facebook groups will give you the traffic boost you’re looking for. Be consistent, stay engaged with your community, and your blog will grow over time!

🚀 Want more? Explore these relevant resources:

- How to Boost Your Blog Traffic as a Beginner

- How to build your blog email list and grow your audience

- How to Promote Your Blog Posts to Get Your Initial Traffic

Consistency wins! Stick with 2-3 strategies, and your traffic will grow.

Simplified Summary

Ready to launch your personal finance blog? Start by picking a clear niche—like budgeting, debt payoff, or retirement savings—to build credibility.

Focus on creating valuable content first. Once you gain some traffic, you can start making money through Google AdSense and affiliate links.

Keep it simple, stay focused on what your readers need, and the growth (and income) will come naturally!

Here’s a Quick Recap on How You Can Get Started:

- Pick Your Niche: Choose a specific niche like saving, investing, or side hustles.

- Get Hosting: Start with HostGator (affiliate link) – use the Hatchling plan for beginners.

- Set Up WordPress: One-click install through HostGator’s dashboard.

- Design Your Site: Pick a clean theme and add key pages (About, Contact).

- Start Posting: Publish 3 starter posts and share them on social media.

💰 Pro Tip: Check our traffic guide to grow faster!

Other Types Of Blogs You May Consider Starting

- How to start a tech blog and make money

- How to start an affiliate-product-based blog

- How to start a lifestyle blog

- How to start a gaming blog that makes money

- How to start a music blog

- How to start a mom parenting blog

- How to start a home decor blog and make money

- How to start a news blog that makes money

- How to start a wine blog and make money

- How to start a relationship blog and make money

- How to start a sports blog

- How to start a golf blog

- How To Start A Profitable Teacher’s Blog [Educational]

- How to start a real estate blog

- How to start an anonymous blog

- How to start a Disney blog

- How to start a health and wellness blog

- How To Start An Outdoor Blog & Make Money

- How To Start A Coaching Blog & Make Money

- How to start a history blog & Make Money